What are Above/Below Options?

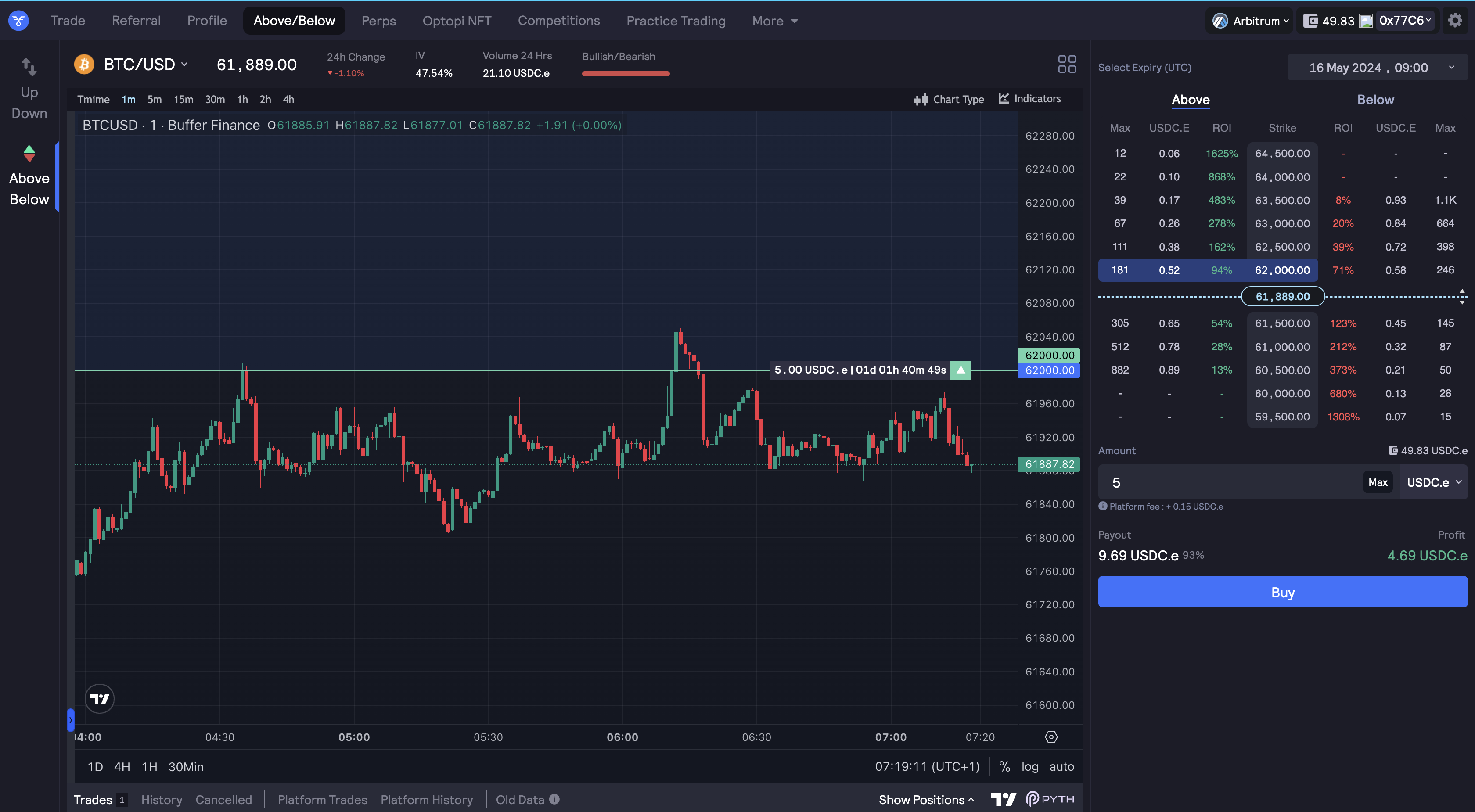

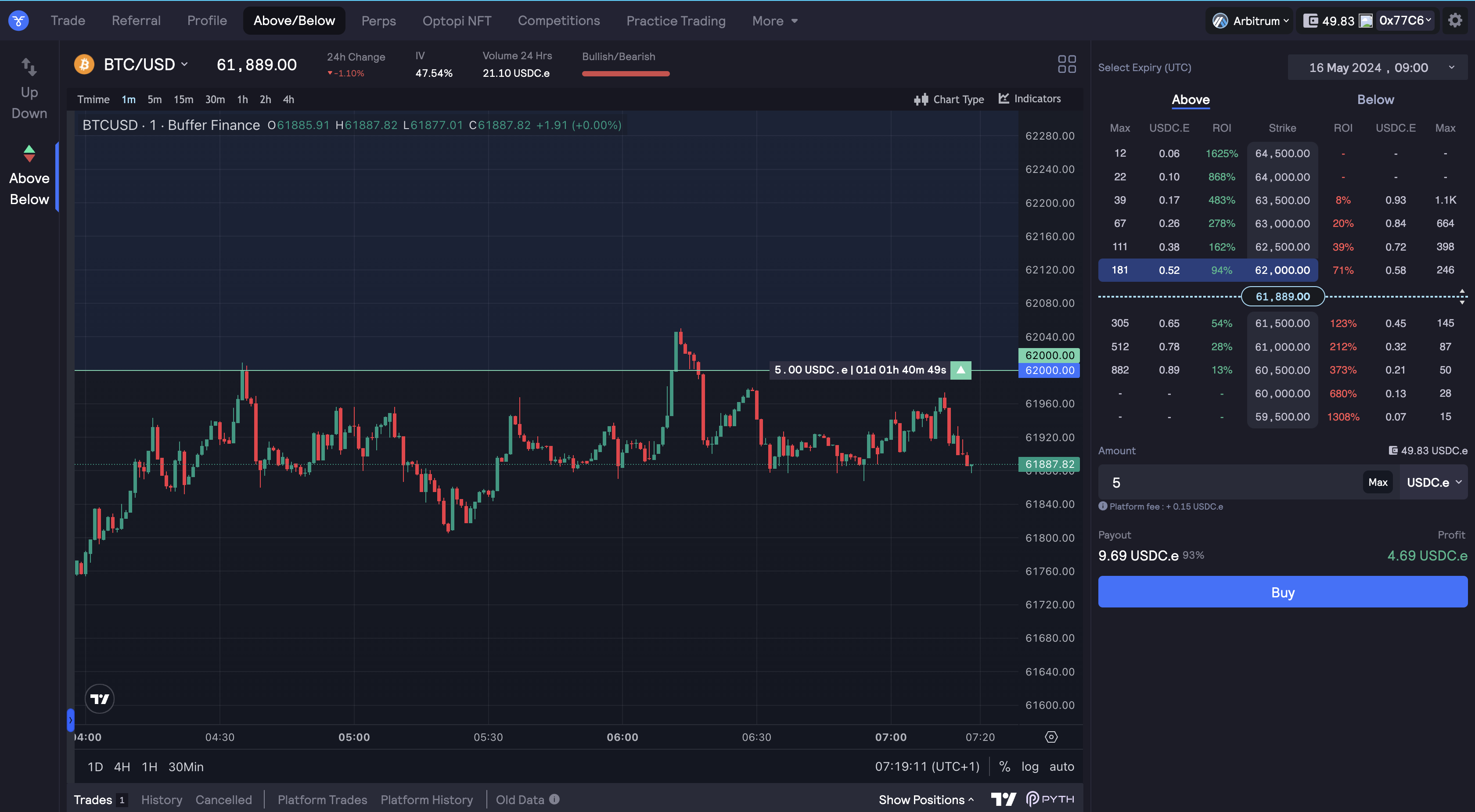

Above/Below options allow you to predict whether the market price will be above or lower than a price target (the barrier) at the end of the expiry.

If you select ‘Above’, you receive the payout if the exit price is above the barrier If you select ‘Below’, you receive the payout if the exit price is below the barrier

If the selected condition is not met, or if the exit price is equal to the barrier your stake is lost.

The principal advantage of above/below options is that they do not require either a stop loss or take profit target.

Above/below options are great for trading when you anticipate low volatility by buying in the money options or when the asset prices fluctuate within a tight range for an extended period of time without trending one way or the other. Meaning, no market movement is required to make profit.

Example:

For the sake of demonstrating a profitable trade, let’s consider the following market variables:

- Pair: BTC/USD

- Strike Price: $43,500

- Time until Maturity: 23 hours

- Current BTC Price: $43,282

With these variables, Buffer prices the above/below contracts of this market as follows: Above: 0.48 USDC Below: 0.62 USDC

The sum cost of the above and below contracts is not exactly 1 USDC. This is due to the presence of a skew impact mechanism that maintains a minimum premium on the contracts, depending on the amount of current underlying risk to the BLP (Buffer Liquidity Pool).

Let’s say a trader uses 100 USDC to purchase exactly 208 Above contracts from the BLP pool, given that the price of 1 Above contract is 0.48 USDC. If, in 23 hours, the price of BTC is indeed above $43,500, our trader will be able to exercise his position. He acquired 1 USDC for each of the 208 contracts he bought. This means his 208 Above contracts will be worth exactly 208 USDC, netting him a profit of 108 USDC on his 100 USDC investment.

If the price of BTC is below $43,500, 23 hours from now, the Below contracts for this market will be worth 1 USDC each, and the Above contracts will be worth 0.