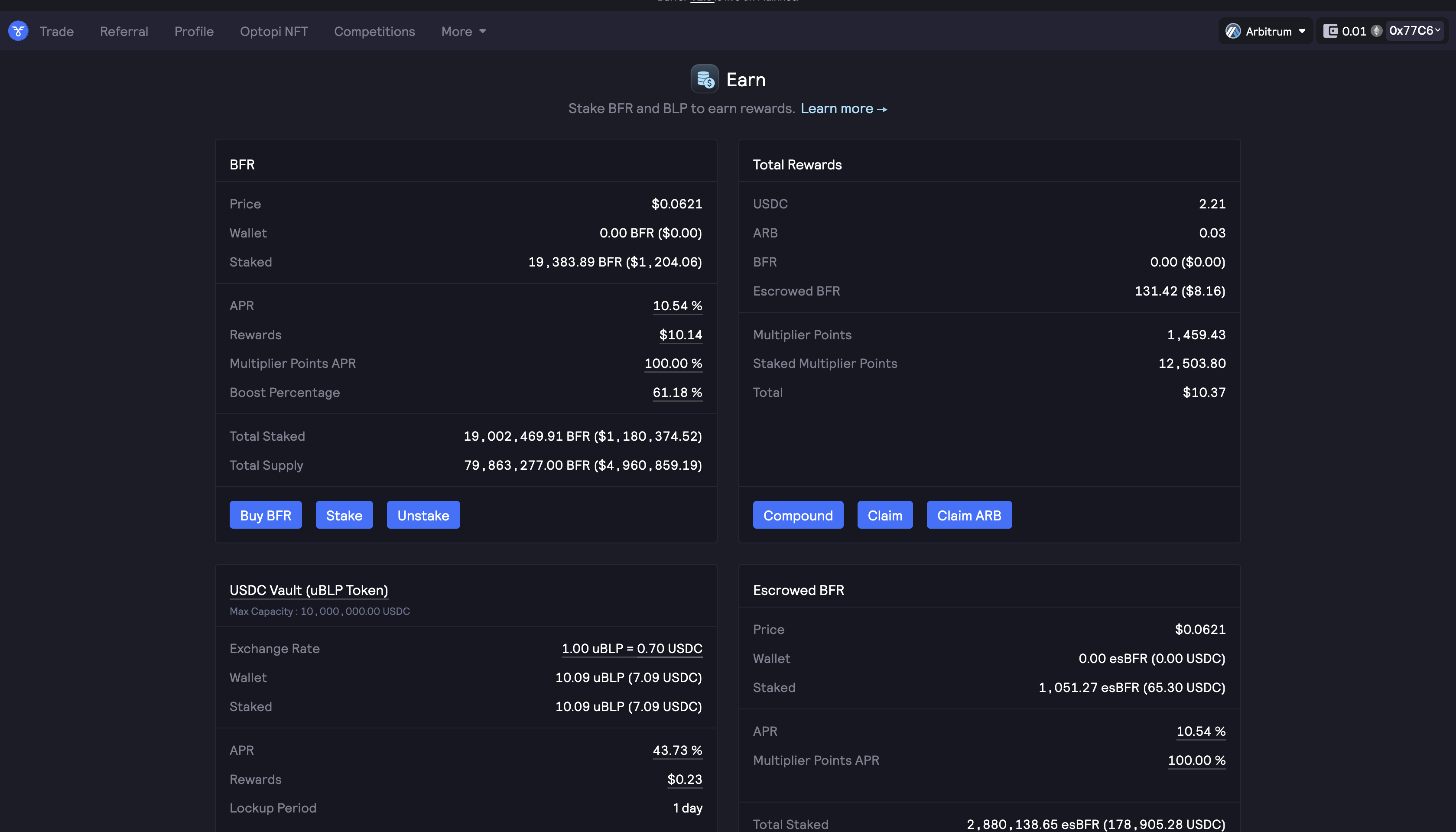

Market Making Vault (BLP)

The Buffer liquidity pools (BLP) provide market-making liquidity for exotic options trading. When an option is bought, a dynamic settlement fee (based on trading volume and payout) charged is sent to the pool, and the pool locks up the corresponding liquidity. When traders win (positive PnL), their winnings are received from the vault. When traders lose (negative PnL), their losses are sent to the vault.

In exchange the vault earns fees for underwriting up/down options trading on Buffer. These fees are proportionally split among Liquidity providers and $BFR stakers.

Pools:

Users can provide liquidity to any of the 2 market-making vaults on Buffer (Arbitrum):

| Vault | Base Asset |

|---|---|

| uBLP | ARB |

| aBLP | USDC |

Once the user deposits liquidity into the pool, they are granted a pool token (BLP) representing their share in the vault. Once minted user's BLP token is automatically staked and starts earning protocol generated revenue.

Diversified Yield:

Protocol generated revenue from up/down options trading (55% - uBLP, 70% aBLP)

BLP Token Pricing:

The price of BLP depends on the price net pending PnL of trader's open positions. Trading (taker) fees from up/down trading and ecosystem fee from perps will automatically increase the price of BLP tokens.

Pool Tokens Received by depositor:

When liquidity is deposited into a pool, it is subject to a 24 hour lock. After this initial 24-hour lock, you can instantly withdraw all of your available funds from a pool at anytime.

Risks:

-

Market Making Risk: LP capital will appreciate or depreciate depending on the performance of the pool's options positions (which is inverse to that of the traders)

-

Smart Contract Risk: There is a risk that contract or UI has a bug or exploit from outlier scenarios, resulting in the loss of funds. This risk is inherent to all smart contracts and relies upon the discipline of the dev community, core contributors and auditors.