Welcome to Buffer Finance Docs

What is Buffer Finance?

Buffer is the first decentralized price prediction market built on Arbitrum to support both crypto and non-crypto (forex, commodities) binary markets and timeframes as short as 1 min.

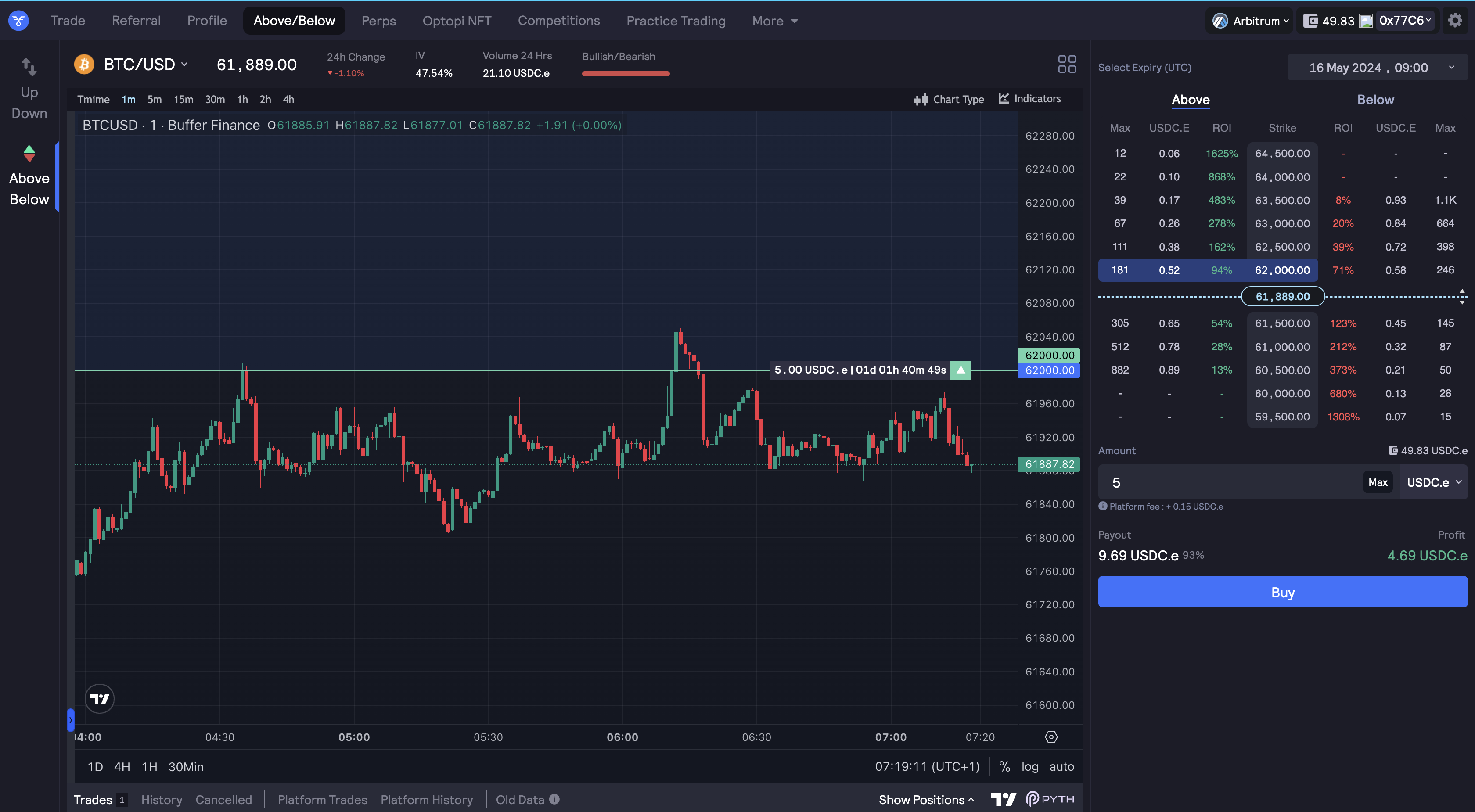

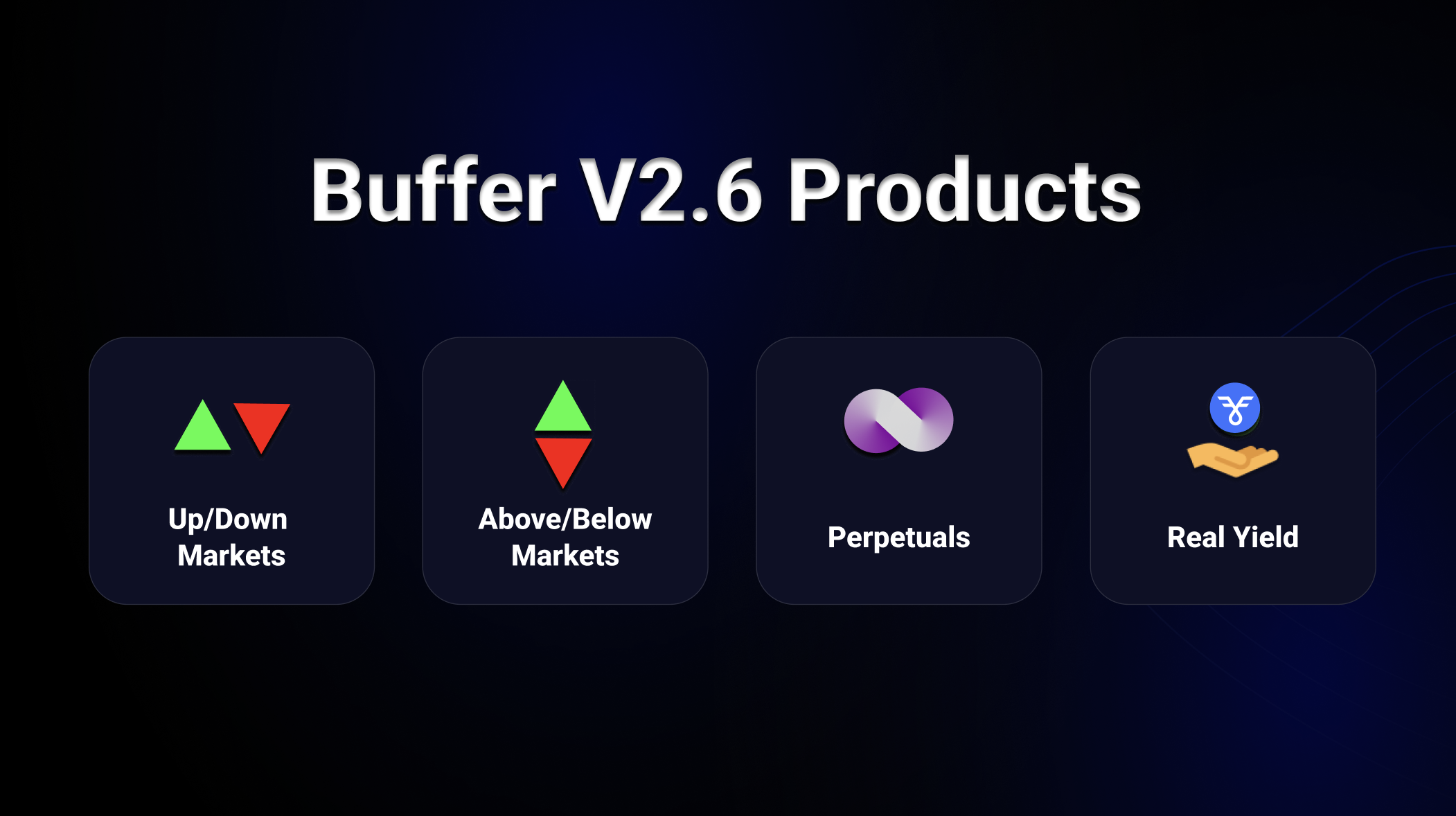

The platform currently supports two primary types of prediction markets: Up/Down and Above/Below. However, the potential to expand and customize market types/formats is extensive. With the launch of v2.6, Buffer's probability based are accessible to anyone permissionlessly. This flexibility opens up endless possibilities for creating tailored and advanced prediction/trading products.

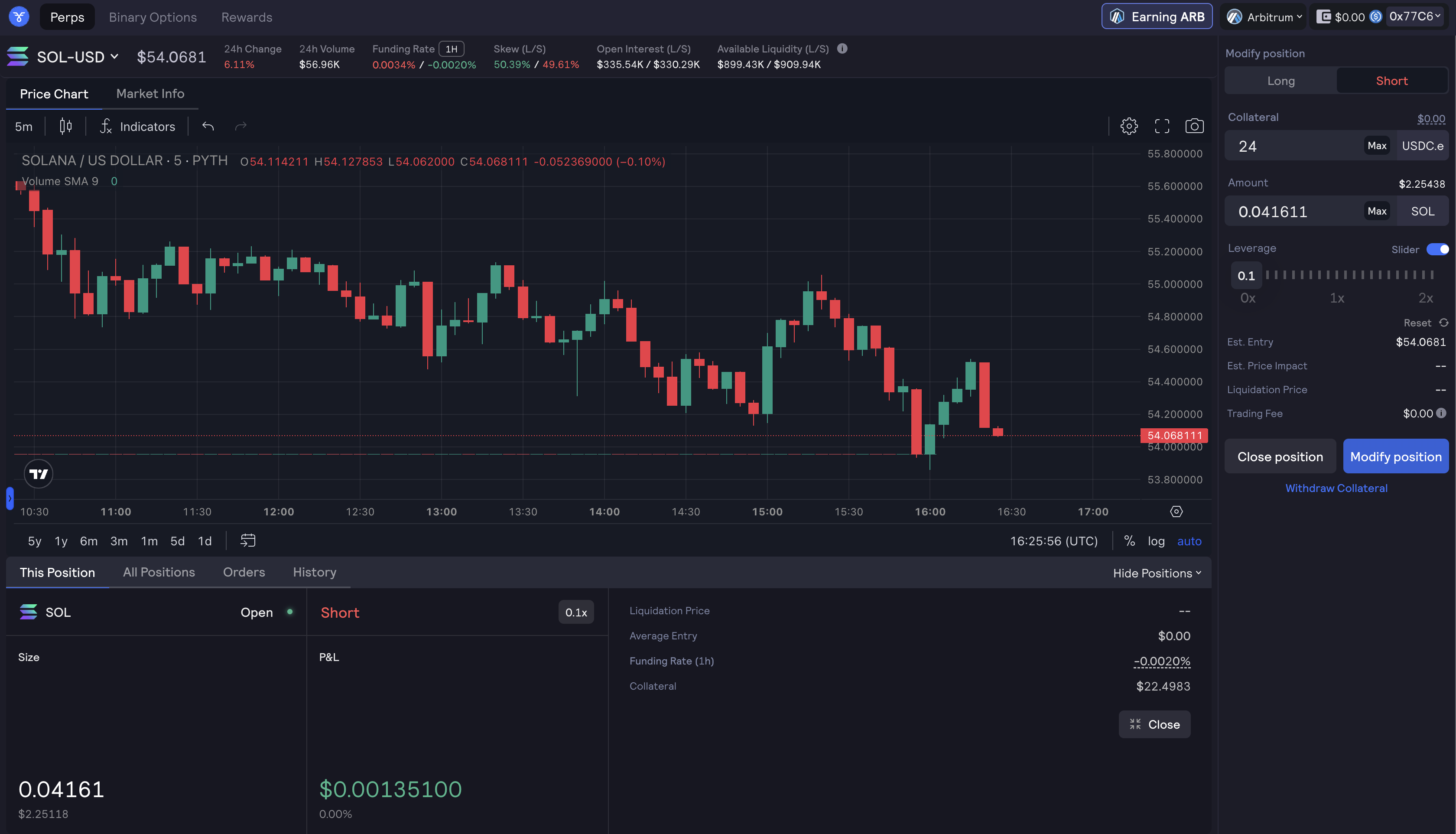

Every market is a ERC-721 contract that mints positions as a NFTs. Traders can purchase a position using supported collateral (USDC/ARB). When the market resolves the winning positions received a payout while the losing positions expire worthless. To provide a comprehensive trading and hedging experience the protocol also supports leverage trading of up to 100x, allowing traders to intuitively hedge risks and adjust exposure structure on a single platform.

Why Trade on Buffer Finance?

✨ One-click, gasless, Instant Trading: Buffer requires zero gas costs, zero wallet approvals (via EIP 2612 permit integration), zero external wallet to trading asset transports, gas top-ups, or any hidden complications for that matter. This is achieved through our gasless 1-Click trading facility, which allows Buffer to emulate the familiar and convenient trading experience of centralized platforms. 1-Click trading is supported on both Up/Down and Abobe/Below Markets.

🔓 Non-Custodial Trading: This means that we do not pose any KYC requirements or have the ability to cease, blacklist, or freeze your account. You have full control over your assets at all times.

⚖️ Fair & Transparent: Buffer utilizes Pyth Network for price feeds for a fair and reliable price source. Fair and transparent distribution of platform rewards, and no requirement of a centralized clearing house.

💠 Multi-asset Collateral: Traders on Buffer are not restricted to a single collateral asset or a specific collateral type based on their trade direction.

🌊 Higher Trading Flexibility: Features like limit orders (using application-level intents) in-chart management and early close significantly improve trading flexibility. Buffer also offers extremely low-latency options trading. This is achieved through our off-chain, sequencer-like facility, which executes multiple trades in groups or queues.

💶 Diverse Market Access: Dive into multiple markets including crypto, forex, and commodities, and find the perfect fit for your trading style.

🔋 Payout Boosts: Unlock up to 90% payouts, and boost them even further with Optopi NFTs or our referral program.

🎚 Advanced Order Types: Tailor your trading with customizable order types, allowing for precise entry and exit points. Optimize your earnings by setting your desired payout levels on limit orders.

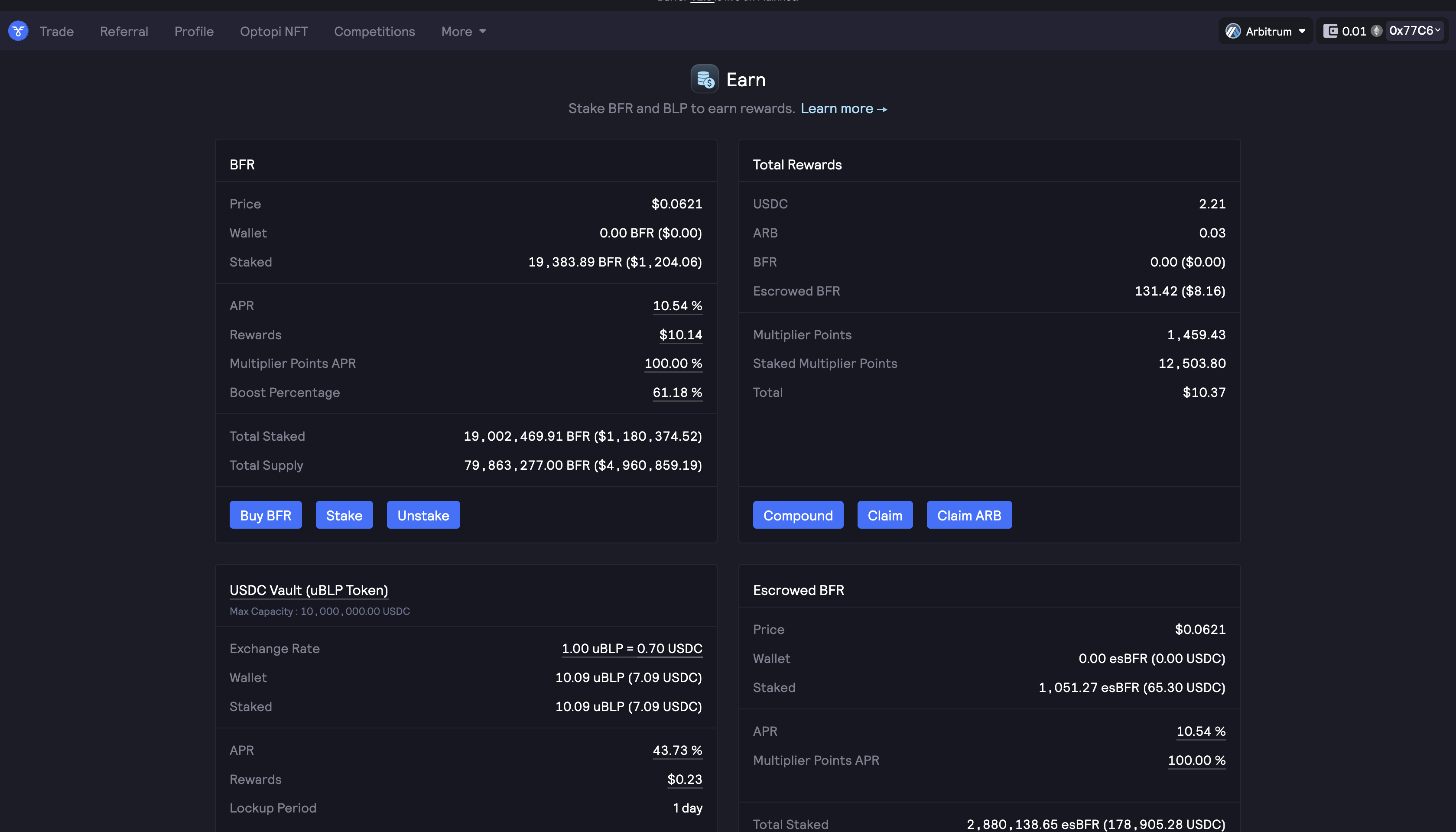

🏦 Market Making Vaults: Trades are powered by USDC & ARB based liquidity pools, which act as the clearing house for options traders. Users can simply deposit assets into the BLP vaults to become market makers on Buffer. LPs enjoy platform fees and exclusive esBFR token rewards.

🛡 Robust LP Protection: Dynamically adjusted fees - maximizing LP returns relative to market conditions and demand for liquidity.

♻️ Flywheel Effect: Buffer's focus on short-term trading instruments enables liquidity to be used multiple times. This efficiency generates higher fees with significantly less capital.

Powered by TradingView:

Buffer uses charts powered by TradingView. A comprehensive trading platform providing market insights and

international market overview. With its assistance,

users can conveniently track BTC chart and

stay informed about other relevant market trends.

Powered by TradingView:

Buffer uses charts powered by TradingView. A comprehensive trading platform providing market insights and

international market overview. With its assistance,

users can conveniently track BTC chart and

stay informed about other relevant market trends.